The Week in Charts: Issue #73

The charts and themes from the past week that tell an interesting story in crypto and investing…

This week’s charts spotlight a major power shift in the Solana ecosystem—Pump.fun has finally been flipped.

I dig into the rise of LetsBonk, the launchpad wars, and why it may (or may not) last. I also explore tokenized stocks as a new frontier for crypto trading, Solana’s booming prosumer economy, and the $2.8B that flowed into crypto VCs in June.

From memecoins to market structure—this issue connects the dots.

1. Launchpad Wars

For the first time ever, the king of Solana launchpads—Pump—has been dethroned.

If you're unfamiliar, Pump is the legendary Solana launchpad that turned memecoin creation into a commodity and gave rise to the now-iconic phrase: “Solana memecoin trenches.”

Since launching in January 2024, it’s racked up over $700 million in revenue, making it arguably the fastest company in history to reach that mark.

But even giants can fall. The launchpad wars are heating up.

You can bet VCs are throwing money at anything calling itself a “Pump.fun killer.”

When there’s $700 million up for grabs, every founder—and their sister—is going to take a swing.

We’ve seen attempts from other chains and even AI-powered launchpads (just another Pump variant, really). But let’s be honest, they never amounted to much, not within their own ecosystems, and certainly not as real competitors to Pump.

Why? Because the memecoin party is on Solana, not Ethereum, not Avalanche, and definitely not Ripple (or whatever L1/L2 you're rooting for).

But on Solana, we’ve actually seen some real contenders.

First, there was Moonshot—the launchpad tied to the Trump memecoin back in January. (Feels like ages ago, doesn’t it?)

Then came BelieveApp, riding the short-lived “internet capital markets” narrative that flared up for about two weeks.

Boop also threw its hat in the ring, experimenting with novel tokenomics.

But the one that’s reignited the conversation is LaunchLabs, the platform behind LetsBonk.

I’ve written before about the synergy between Pump and Raydium. LaunchLabs takes a similar route—acting as both a memecoin launchpad and a launchpad for launchpads. And so far, LetsBonk stands out as one of its early success stories.

Volumes on LetsBonk started picking up toward the end of June, and by early July, they had exploded.

They’re currently running a trading competition, which might explain the surge. But regardless, starting July 5th, LetsBonk officially flipped Pump in terms of token creation on Solana.

At its peak, LetsBonk accounted for 66% of new tokens, while Pump dropped to 26%.

On July 8th alone, 22,309 coins were created on LetsBonk, compared to 8,657 on Pump.

As of now, LetsBonk still leads, responsible for 60% of all new tokens launched.

The memecoin game is ultimately a numbers game.

The more tokens launched on your platform, the stronger the signal, not just of interest, but of success.

These platforms typically earn fees when tokens are created and again when they graduate into liquidity pools on underlying DEXs. The mechanics vary, but the model is broadly the same.

Of course, sheer volume isn’t enough. You can launch thousands of worthless coins that go straight to zero.

What really matters is retention—if users stop coming back, it means the odds of hitting a life-changing runner are too low to keep the dream alive.

What you want to see is a launchpad consistently graduating a healthy percentage of its tokens—that’s what keeps users coming back and drives sustainable revenue for the platform.

As you might’ve guessed, LetsBonk is outperforming PumpFun on this front too. On July 7th, LetsBonk peaked with a 60% graduation rate, compared to Pump’s 31%.

That number has since dipped slightly to 55%, but it still comfortably leads the pack.

These are two metrics where no other competitor has ever flipped Pump—until now.

There’s a first time for everything, and this might just be it. The big question is whether LetsBonk can sustain the momentum.

The final—and arguably most important—metric is revenue.

Let’s take a look.

As LetsBonk took off, its daily revenue surged alongside it.

The more surprising—and concerning—development was PumpFun’s revenue decline, which sparked speculation that users were migrating from Pump to Bonk.

Pump’s daily revenue dropped from over $1.5 million in June to around $500k today. Meanwhile, Bonk went from virtually zero to over $1 million in daily revenue.

There’s a clear inverse correlation—Bonk’s recent revenue dip has coincided with a slight rebound for Pump.

Just look at the numbers we’re talking about—$1 million, $500k in daily revenue.

How many businesses pull that off?

Better yet, how many startups under 3 months old are hitting $1 million a day? Welcome to crypto.

Whatever happens next, these are impressive numbers for both launchpads.

May the best one win.

To wrap up the Launchpad Wars section, I still think PumpFun comes out on top.

The traction LetsBonk is seeing feels short-term. Of course, "short-term" is always debatable; it could last way longer than expected. So no, you probably shouldn’t be short $BONK.

But over a long enough timeline, Pump wins.

Just like people underestimated the staying power of the memecoin boom, they’re now underestimating PumpFun.

For what it’s worth, I think LetsBonk’s growth has already peaked—at least relative to Pump.

2. A New Asset to Trade

Crypto is, at its core, a trading industry. Our most successful use case so far is trading-as-a-service—something I’ve been consistently vocal about (and written on here).

Now, there’s a new addition to the menu: tokenized stocks.

They’re like synthetic stocks, but better. Not the actual equities themselves, but 1:1 backed by the real thing via an SPV (special purpose vehicle). It’s a bit technical, but if you’re curious, look it up.

Or just read this short TLDR if you’re pressed for time.

Tokenized stocks are on-chain versions of real-world equities, backed 1:1 by actual shares held by a licensed custodian or SPV.

They trade 24/7, settle instantly, and are accessible to anyone with an internet connection—no TradFi middlemen required. Think of them as synthetic stocks, but with real backing and the full benefits of on-chain composability.

Robinhood launched its own version a few weeks ago, including not just tokenized public stocks but also private equity. There was some drama about whether the OpenAI shares they were offering were actually backed 1:1, but that’s since been cleared up.

That said, I don’t think it really matters, at least not to crypto natives. Most of the trading volume in crypto comes from perps, which aren’t the actual asset either. We’re already used to trading representations, not the underlying.

Look at ETFs in TradFi, most people buying something like IBIT don’t care about owning actual Bitcoin. They just want exposure to the upside.

Even with real stocks, most investors don’t vote. And not every company even offers voting rights to shareholders in the first place.

TradFi investors care about two things: price appreciation and dividends. Crypto traders only care about one thing—upside. And tokenized stocks give them exactly that.

Backed Finance recently launched xStocks on Solana in partnership with Kraken. Unlike Robinhood’s offering, this doesn’t include private equity—just tokenized public stocks.

Unsurprisingly, trading activity tends to drop on weekends, mirroring traditional stock market behavior. Daily volume peaked at $8.5 million on July 2nd and has been declining since.

Most of the trading volume is concentrated in SPYx, TSLAx, MSTRx, AAPLx—and surprisingly, CRCLx. It’s the usual suspects from the Mag 7, with one exception: Circle. That’s a small but clear win for crypto.

The drop in trader activity and swap counts has been even sharper than the decline in daily volumes.

Trader numbers peaked early—hitting 6.5k on July 1st—while swaps peaked two days later with over 23,000.

By comparison, last week saw just 11,000 traders and around 73,000 total swaps.

I think we’re still early, and tokenized stocks will eventually take off.

They offer two major value props:

24/7/365 global trading. These assets can be accessed from anywhere in the world. That’s permissionless markets in action.

Backed’s xStocks are already live on Solana and open to everyone. Robinhood’s version is still whitelisted and trades only 24/5—for now. But their goal is clearly to catch up.

What makes xStocks even more compelling is that they’re composable with DeFi. You can use your TSLAx as collateral to borrow on Aave, just like you would with ETH or stETH.

This opens up new possibilities:

For crypto users, it’s a seamless way to hold and use TradFi assets within their on-chain setup.

For TradFi users, it unlocks more utility from the stocks they already own. Think Apple dividends are too low? No problem, lend your AAPLx and earn extra yield.

The second reason this matters is tokenized private equity—an area Robinhood seems to be leaning into more aggressively.

I’ve shared some of my thoughts on Twitter about tokenized stocks. Let me just drop them here:

Another one

Another key point: tokenized stocks give us access to invest in our favorite AI companies.

More companies are staying private for longer—they have plenty of capital and don’t need to go public. So while transformative technologies like AI, space, and robotics are booming, most of us are locked out. These opportunities aren’t open to the public, which means we miss out on the upside.

This is the first time in a major technological shift where everyday people can’t directly invest in the tech shaping the future.

xStocks change that—and the best part?

They’re powered by crypto. We really saw this coming.

3. The Revenue Meta

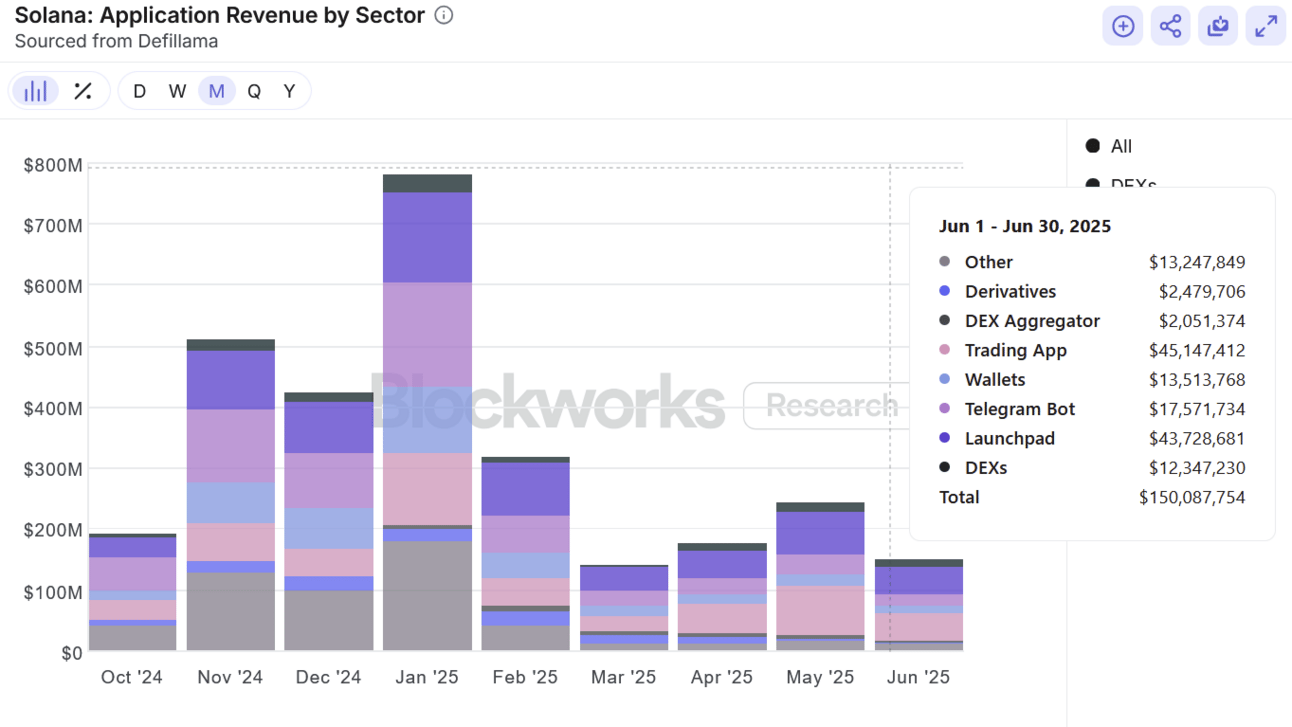

Solana apps generated $150 million in revenue last month, 90% of it from trading activity. That includes DEXs, launchpads, Telegram bots, and other trading-focused tools.

Solana is where the users are. It’s the industry's most active chain today, so what’s true for Solana is likely true for the rest of crypto, with 80%+ confidence.

This reinforces two core truths:

Crypto is fundamentally a trading industry. Its most proven use case today is trading-as-a-service, and that’s something most of us can agree on.

Crypto is built for prosumers, not everyday consumers. There’s a lot of talk about simplifying UX to onboard the next billion users, making it intuitive enough for your mom. But that vision assumes mass adoption happens on-chain, when it’s more likely to start through centralized platforms.

I agree with that vision, but I think the polished, intuitive UX for everyday users will come from CEXs like Binance and Coinbase. That’s where regular consumers are most likely to go.

Meanwhile, the on-chain world will remain the domain of crypto natives. And by design, it’s going to cater more to prosumers than casual users.

We saw the same pattern last cycle, Blur ate into OpenSea’s market share and still holds it today. And we’ve seen it again this year with Moonshot and Axiom.

Moonshot went after regular consumers and saw a spike during the Trump memecoin frenzy. But Axiom launched later with a focus on prosumers, and now it’s doing serious numbers, while Moonshot has largely faded.

The top revenue-generating apps on Solana last month weren’t built for casual users; they were designed for prosumers.

Focus on building for the 20% of power users driving the majority of your revenue, rather than diluting the product to cater to the remaining 80% who contribute far less.

4. Crypto VC in June

$2.8 billion was raised in June, just below March’s peak of $2.9 billion.

The largest equity rounds included Kalshi’s $185 million Series C, valuing the company at $2 billion. Other notable raises were Digital Assets at $135 million and Zama at $57 million.

If we include private token sales, the figures rise even higher.

World Liberty Financial, a Trump-backed venture, reportedly sold $100 million worth of its WLFI token to investors in the UAE. a16z also made significant token purchases—$70 million in EigenLayer’s token and $135 million in WLD (Worldcoin), the latter in partnership with Bain Capital.

The AI category led by deal count, with 21 projects raising a combined $116 million in June.

But when it comes to capital raised, prime services dominated. This category, covering crypto firms that offer a broad suite of financial services, saw just five projects raise a staggering $1.5 billion collectively.

June’s $2.8B in funding marks the second-highest monthly raise in over three years, just behind March.

But back in March, the Binance and MGX deals made up more than half of the total—skewing the numbers heavily.

June, by contrast, was less top-heavy and more broadly distributed, arguably a much healthier fundraising environment.

And that's it for this week.

Have a great week, everyone.

- Passie

Forwarded this email? Sign up here to subscribe